Former employees of Bojangles in Marlboro, Maryland allege gross mismanagement of company money.

Allegations ranging from:

- wage theft

- counterfeit checks

- fraudulent W-2’s

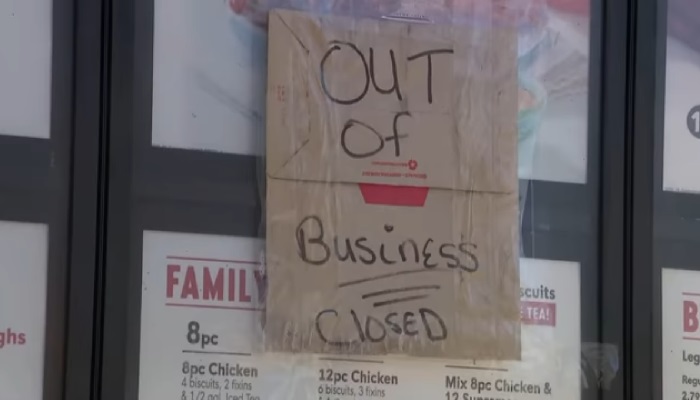

All 5 locations in Prince George’s County, Maryland were under the same ownership and have all been closed.

It has been reported that the franchisee owners owe $69,000 in back property taxes.

Finally, it has been discovered that the owners filed bankruptcy in New Jersey listing the 5 restaurant locations as assets.

The Department of Labor is now involved along with the IRS.

It became so bad, according to the unemployed Shift Manager, that the Bojangles restaurant went through periods of running out of food and the employees had to reach out to neighboring fast food restaurants such as Popeye’s, Checkers, and Safeway to get chicken, buttermilk and even ice for customers.

(A terrible ‘plan’ I would say)

Corporate Bojangles told employees that the franchisee no longer works for the company and they would have to take up any issues with the former franchisee.

In a statement to Channel 9 WUSA in Maryland:

Of course, the franchisee has not been returning calls.

The Mayor and the Department of Labor have been notified and former employees have been advised by advocates to pursue civil remedies.

Strategic Lessons:

There is so much more to this story yet to be reported, but for the purposes of our blog, we wanted to take some strategic lessons out of this.

First, the franchisee should have known that the business was amiss long before the ‘real’ trouble began, therefore, safety measures should have been set into motion to avoid and/or to mitigate any future problems.

Many times, some measures that are available to a troubled business are not the best choices for employees, or for that matter, the business owners, such as pay-cuts, layoffs, bringing in investors, and even a partner with fresh ideas and advanced operational skills.

Not everyone involved is going to be happy when things go bad in a business, especially when hard decisions need to be made to ‘save the business’, but if emotions are paused, and the correct strategic decisions are implemented, and the business is ultimately salvaged, and then returns to profitability, then plans can move forward to continue, to at the very least, operate the business, not to mention the many lessons that would have been learned.

On the other hand, since this particular franchisee did not plan for the worst and allowed the business to go down like the titanic, many good people are going to suffer.

As healthy Small Business Owners, we have to be ready to strike.

What I mean is this… that if another healthy Small Business Owner had this forthcoming disaster in their sights, and as astute business owners, we should always be on the look out for opportunities, then maybe, after careful evaluation, another local business owner may have been able to either partner up with the franchisee early on, or offer to buy out the current owner outright, if in fact the new business owner had the savvy to turn the failing business around.

This is just one of many examples where fast funding may be of some help to savvy and healthy Small Business Owners who have a desire to take advantage of growth opportunities.

By doing so, not only would the Small Business Owner benefit with potential added revenue, but the community could also benefit with sustainable jobs.